Page 106 - 泰國

P. 106

泰國投資環境簡介

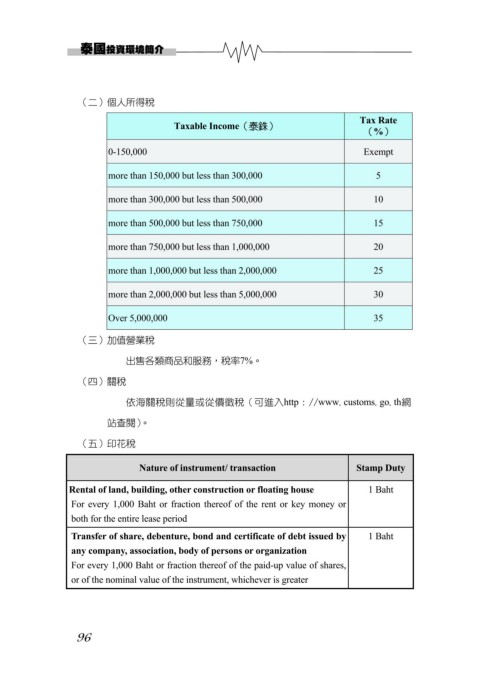

(二)個人所得稅

Tax Rate

Taxable Income(泰銖)

(%)

0-150,000 Exempt

more than 150,000 but less than 300,000 5

more than 300,000 but less than 500,000 10

more than 500,000 but less than 750,000 15

more than 750,000 but less than 1,000,000 20

more than 1,000,000 but less than 2,000,000 25

more than 2,000,000 but less than 5,000,000 30

Over 5,000,000 35

(三)加值營業稅

出售各類商品和服務,稅率7%。

(四)關稅

依海關稅則從量或從價徵稅(可進入http://www.customs.go.th網

站查閱)。

(五)印花稅

Nature of instrument/ transaction Stamp Duty

Rental of land, building, other construction or floating house 1 Baht

For every 1,000 Baht or fraction thereof of the rent or key money or

both for the entire lease period

Transfer of share, debenture, bond and certificate of debt issued by 1 Baht

any company, association, body of persons or organization

For every 1,000 Baht or fraction thereof of the paid-up value of shares,

or of the nominal value of the instrument, whichever is greater

96