Page 33 - 厄瓜多

P. 33

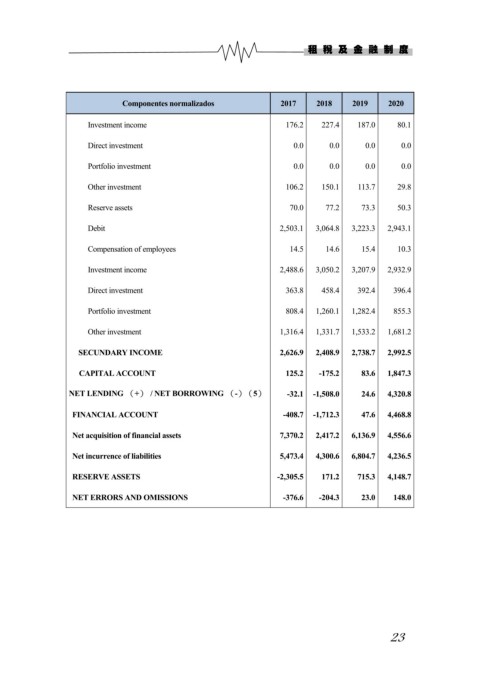

租稅及金融制度

Componentes normalizados 2017 2018 2019 2020

Investment income 176.2 227.4 187.0 80.1

Direct investment 0.0 0.0 0.0 0.0

Portfolio investment 0.0 0.0 0.0 0.0

Other investment 106.2 150.1 113.7 29.8

Reserve assets 70.0 77.2 73.3 50.3

Debit 2,503.1 3,064.8 3,223.3 2,943.1

Compensation of employees 14.5 14.6 15.4 10.3

Investment income 2,488.6 3,050.2 3,207.9 2,932.9

Direct investment 363.8 458.4 392.4 396.4

Portfolio investment 808.4 1,260.1 1,282.4 855.3

Other investment 1,316.4 1,331.7 1,533.2 1,681.2

SECUNDARY INCOME 2,626.9 2,408.9 2,738.7 2,992.5

CAPITAL ACCOUNT 125.2 -175.2 83.6 1,847.3

NET LENDING (+) / NET BORROWING (-)(5) -32.1 -1,508.0 24.6 4,320.8

FINANCIAL ACCOUNT -408.7 -1,712.3 47.6 4,468.8

Net acquisition of financial assets 7,370.2 2,417.2 6,136.9 4,556.6

Net incurrence of liabilities 5,473.4 4,300.6 6,804.7 4,236.5

RESERVE ASSETS -2,305.5 171.2 715.3 4,148.7

NET ERRORS AND OMISSIONS -376.6 -204.3 23.0 148.0

23