Tax Base

For any individual having income from sources in Taiwan, income tax is levied in accordance with the Income Tax Act.

Tax on Non-Residents

An individual is considered non-resident in Taiwan if he/she is not domiciled in Taiwan and stays in Taiwan for less than 183 days in a taxable year. In general, income tax of non-residents is collected through withholding at source. However, non-residents who have income not subject to withholding tax should file an income tax return before their departure from Taiwan. No matter what income non-residents have, they are not entitled to any exemptions or deductions.

If an individual stays in Taiwan for less than 90 days in a taxable year, income received from a foreign employer is exempt from Taiwan income tax (if an individual's residence state has an applicable treaty with Taiwan, generally the criteria could be prolonged to 183 days).

Tax on Residents

The term "resident" as used in the Income Tax Act, refers to:

- A person who has domicile within Taiwan and habitually resides within the territory of Taiwan; or

- A person who is not domiciled in Taiwan but resides within the territory of Taiwan for 183 days or more during a tax year.

A resident individual must file an income tax return between May 1 and May 31 of the following taxable year and pay any tax due. The tax return must include income, as well as exemptions and deductions of the taxpayer's household members, including the taxpayer, his or her spouse, and dependents.

Exemptions

When a resident files an income tax return, he/she can deduct exemption per household member. Exemptions increase by 50% if the taxpayer, his/her spouse and lineal ascendants are 70 years of age or older. For the 2025 individual income tax return, the exemption is NT$97,000 for each household member, or NT$145,500 for each taxpayer, spouse, and lineal ascendant, who are 70 years old and above.

Deductions

A taxpayer may select either the standard deduction or itemized deductions and may, in addition thereto, declare special deductions in their household. The amounts of the deductions allowed for the 2025 individual income tax returns are disclosed as follows (if the amount of total itemized deductions exceeds the amount of the standard deduction, an optimal selection is to claim the itemized deductions):

Standard deduction

NT$131,000 for a single taxpayer and NT$262,000 for married persons filing jointly in 2025.

Allowable itemized deductions

- Contributions and donations: For the taxpayer, his (her) spouse, and dependent(s), contributions and donations made to educational, cultural, public welfare or charitable organizations or institutions in a total amount not in excess of 20% of the total amount of the gross consolidated income is deductible. However, there is no limit to the amount of donations or contributions made for the support of national defense or troop morale or contributions to the government.

- Insurance premiums: Premiums paid by or for the taxpayer, his (her) spouse, or lineal dependent(s) on life insurance, labor insurance, national pension insurance and insurance for military personnel, public servants or teachers, with the deductible amount not to exceed NT$ 24,000 for each person per year. However, there is no limit to the amount of the premium paid for national health insurance.

- Medical and maternity expenses: Medical and maternity expenses incurred by the taxpayer, his (her) spouse, or dependent(s) provided that payments so made are limited to those paid to public hospitals, the hospitals or clinics appointed under the National Health Insurance, or those hospitals having complete and accurate accounting records as recognized by the MOF. However, no deduction shall be made for the portion (of such expense) covered by an insurance payment.

- Losses from disaster: The portion of loss incurred by the taxpayer, his (her) spouse or dependent(s) from a disaster caused by force majeure. However, no deduction shall be made for the portion of loss for which an insurance benefit or relief has been received.

- Interest on a house mortgage: The interest payable on a loan from a financial institution by a taxpayer, his (her) spouse, and dependent(s) for the purpose of a house for his (her) own use may be deducted from his (her) consolidated income, with the deductible amount not to exceed NT$ 300,000 per year per tax return. However, if a special deduction for savings and investment has been made in the same tax return, the amount of such special deduction shall be subtracted from the aforesaid interest of the house mortgage; the deduction for interest on the house mortgage is limited to one house only.

Special deductions

- Special deduction for losses from property transactions: The amount of loss from property transactions incurred by a taxpayer, his (her) spouse, and dependent(s) which is deductible in one year shall not exceed the declared amount of income derived from property transactions in the same year. However, if no income or no sufficient income derived from property transactions in the same year is available for deduction, the loss may be carried forward in the next three years.

- Special deduction for employment income: For a taxpayer, his (her) spouse, and dependent(s) having employment income, the deductible amount not to exceed NT$ 218,000 per year may be deducted for each person beginning in 2024.

- Special deduction for savings and investment: Interest derived from deposits in financial institutions, income from trust funds in the nature of savings, or earnings and dividends derived at the time of transfer, gift, distribution of estate or upon giving up the tax-deferring right or delivering the stock to the custodian, on tax-deferred publicly issued and traded stock acquired on or before December 31, 1998 by taxpayer, his/her spouse and dependents may be deductible up to NT$270,000. However, this limit of deduction does not apply to the interest accrued and exempt from income tax on postal pass-book savings under the provisions of the Post Savings and Remittances Act and the interest accrued on short-term commercial papers subject to separate taxation as stipulated in law.

- Special deduction for the disabled: If the taxpayer, his (her) spouse, or dependent has a disability certificate or is a patient as defined in Subparagraph 4, Article 3 of the Mental Health Act, a deduction of NT$ 218,000 per year may be made for each such person beginning in 2024.

- Special deduction for educational tuition: If any of the children of a taxpayer is studying in a college or university, a deduction of NT$ 25,000 per child per year may be made for his (her) educational tuition. However, the tuition of the Open University, vocational colleges, the first three years of five-year vocational colleges, and students who have accepted government subsidies are excluded.

- Special deduction for pre-school children: Starting from 2024, for a taxpayer who has children under or equal to six years of age, the amount of deduction for the first pre-school child is NT$150,000 per year; the amount of deduction for a second child and more is NT$225,000 per child per year.

- Special deduction for long-term care: Starting from 2019, the taxpayer, his (her) spouse or dependents who is a qualified person with physical and mental incapacity and need long-term care services prescribed by the Ministry of Health and Welfare, a deduction of NT$120,000 per year may be made for each person.

- Special deduction for rent for housing: Starting from 2024, rent for housing in the R.O.C. paid by a taxpayer his (her) spouse, and lineal dependent(s) and used as their own residence rather than for business or performing professional services, may be deducted from their consolidated income to the extent of NT$180,000 per year per tax return, not including government subsidy. However, no deduction shall be made for taxpayers, their spouses, or lineal dependent(s) who own a house in the R.O.C.

- However, the special deductions for long-term care and rent for housing are not applicable to taxpayers whose consolidated individual income tax rate, after the amount of the deductions mentioned above have been deducted, is greater than or equal to 20%, or to those who opt for the single tax rate of 28% on dividend income computed separately from their consolidated income, or to those whose annual total amount of basic income is greater than NT$7,500,000.

Income Tax on Dividend

By abolishing the partial imputation tax system on dividends, a new dividend tax regime was put into practice in 2018. Such regime allows resident taxpayers be able to choose either to incorporate dividend income into their consolidated income to calculate their tax based on progressive income tax rates, with a tax credit of 8.5% of the total dividend amount, with the credit ceiling set at NT$80,000 per household; or to opt for the single tax rate of 28% on dividend income computed separately from their consolidated income.

According to Article 44-1 of the Business Mergers and Acquisitions Act, in cases where a company is dissolved due to the merger or division, the individual shareholders who acquire the shares of the surviving company or the newly incorporated company after the merger or division can choose to defer the dividend income tax. The individual shareholders’ dividend income tax calculated in accordance with the provisions of the Income Tax Act will be deferred for the first two years after the year of receiving dividend, but levied evenly afterwards for the next three years.

Alternative Minimum Tax (AMT)

As of January 1, 2006, the AMT has been effective and is applicable to resident individuals. An individual need not report AMT if he/she is not deemed to be a Taiwan resident, or did not claim investment tax credit, or did not have any add-back items taken as tax reduction/exemption under the laws (e.g. Income Tax Act) in the same tax year, or the basic income amount is less than NTD7,500,000. From January 1, 2021, income derived from transactions of stocks, certificates of entitlement to new shares, certificates of payment and documents of title to shares issued or private placed by companies not listed on the stock exchange or traded on over-the-counter markets (hereinafter referred to as “Securities not listed on SE or traded on OTC markets”) has been counted in the basic income amount, but those companies approved by the central authority in charge of relevant enterprises as high-risk innovative startups and incorporated for less than five years have been excluded.

AMT should be reported and calculated based on one tax filing household as follows:

Basic Income Amount = Regular Net Taxable Income as Prescribed in the Income Tax Act +the total amount of the dividends and earnings which is chosen to calculate the tax payable separately+ Overseas Income + Life and Annuity Insurance Payment Received by the Beneficiary Where The Beneficiary and the Proposer of the Insurance are Different (In The Case of Payment Made upon the Death of the Insured Person, the Part of Which Aggregate of Payment Made in Filing Unit is Equal to or Less Than NT$37,400,000 May be Excluded from the Basic Income) +Income Derived from Transactions of Securities not listed on SE or traded on OTC markets and Beneficiary Certificates of Privately-Placed Securities Trust Funds + Non-Cash Donation+The amount of income or deduction which leads to reduction, exemption, or deduction from the consolidated income tax as may be provided for by laws which may be publicly announced by the MOF

Tax Rates

The net taxable income of an individual is subject to the following progressive tax rates for year 2025:

| Net Taxable Income of year 2024 (NT$) |

Tax Rate |

Progressive Difference (NT$) |

| 0 - 590,000 |

5% |

0 |

| 590,001 - 1,330,000 |

12% |

41,300 |

| 1,330,001 - 2,660,000 |

20% |

147,700 |

| 2,660,001 - 4,980,000 |

30% |

413,700 |

| 4,980,001 and above |

40% |

911,700 |

The Calculation of employment income

From January 1, 2019, the means to calculate employment income for residents is based on a lump-sum deduction or an itemized expense deduction, including vocational clothing expenses, upgrading training expenses, and vocational tool expenses, with an upper limit of 3% of the salaries/wages each. The taxpayer can choose the best option.

Illustration of Income Tax Computation

Assumptions (for year 2025):

- Taxpayer files a joint income tax return with his/her spouse (both are under the age of 70). They have a child studying in a college, and the tuition is NT$32,000 per year.

- Taxpayer receives Taiwan source wages NT$5,000,000 and chooses a lump-sum deduction of NT$218,000 for calculating employment income which will be NT$4,782,000.

- The standard deduction is claimed.

Unit: NT$

| Item |

Resident |

Non-resident |

| Taiwan-source taxable income/total amount paid |

$4,782,000 |

$5,000,000 |

| Minus: |

|

|

| Personal exemption (NT$97,000 × 3) |

291,000 |

(Not Applicable) |

| Standard deduction |

262,000 |

(Not Applicable) |

| Special deduction for educational tuition (NT$25,000 × 1) |

25,000 |

(Not Applicable) |

| Net taxable income |

4,204,000 |

5,000,000 |

| Tax rate |

30% |

18% |

| |

1,261,200 |

|

| Less: Progressive difference |

( 413,700 ) |

( - ) |

| Tax liability |

$847,500 |

$900,000 |

Note: Withholding tax paid during a year may be used as a credit to offset the tax liability of resident taxpayers. Non-resident taxpayers are taxed by withholding at source.

The relevant rule to calculate the basic income and basic tax

If an individual resident has overseas income and its annual total amount in the filing household is equal to or more than NT$1,000,000, it shall be included in the basic income. The amount of basic income is the sum of the net taxable income, overseas income, and other added items. The balance after deducting NT$7,500,000 from the basic income is calculated as a basic tax at a tax rate of 20%. If the basic tax exceeds the regular income tax payable, the individual must pay the difference. The income tax which has been paid in accordance with the tax laws of the source jurisdiction of that overseas income may be credited against the basic tax within the limit.

- Creditable amount of foreign tax paid shall refer to the foreign tax paid or the ceiling on the amount of tax credited, whichever is lower.

- The Ceiling on the Amount of Tax Credited = (Basic Tax - Regular Income Tax Payable - Separately Calculated Dividends and Earnings Tax Payable) × Overseas Income ÷ (Basic Income - Net Taxable Income – Total Amount of Separately Calculated Dividends and Earnings)

- Calculation Illustration(Year 2025)

-

Unit: NT$

| |

Example 1 |

Example 2 |

Example 3 |

| Overseas income |

3,500,000 |

3,500,000 |

6,000,000 |

| Onshore income |

|

|

|

| Net taxable income |

2,000,000 |

5,500,000 |

5,500,000 |

| Particular insurance proceeds |

0 |

1,000,000 |

1,000,000 |

| Particular security transaction income |

0 |

1,500,000 |

1,500,000 |

| Non-cash donation |

0 |

500,000 |

500,000 |

| Basic income amount |

5,500,000 |

12,000,000 |

14,500,000 |

Basic tax amount (B)

(Basic income amount - NTD 7,500,000) × 20% |

- |

900,000 |

1,400,000 |

Regular tax payable (D)

(Income tax payable - Investment tax credit) |

260,000 |

1,136,000 |

1,136,000 |

B≦D, No AMT.

B>D, (E) the difference between B and D |

- |

- |

264,000 |

| Creditable amount of foreign tax paid (C) |

|

|

176,000 |

| AMT payable(E)-(C) |

|

|

88,000 |

| Total tax payable (D)+(E)-(C) |

260,000 |

1,136,000 |

1,224,000 |

| |

|

|

Assume tax paid overseas is NTD 300,000. The foreign tax credit ceiling = (1,400,000-1,136,000)×6,000,000÷9,000,000=176,000 |

Individual Controlled Foreign Company Rule

- In order to prevent individuals in Taiwan from avoiding taxation by setting up controlled foreign companies (hereafter CFC) in tax havens to retain earnings rather than distribute them to shareholders in Taiwan, the CFC rules for individuals were drafted in Article 12-1 of the Income Basic Tax Act, by reference to Organization for Economic Co-operation and Development (OECD) Base Erosion and Profit Shifting Projects (BEPS) Action Plan 3, to reinforce sound anti-avoidance systems. The Article 12-1 of the Income Basic Tax Act was promulgated by the President on May 10, 2017. On January 14, 2022, the Executive Yuan has designated that Article 12-1 of the Income Basic Tax Act shall be enforced from January 1, 2023.

- Article 12-1 of the Income Basic Tax Act regulates that for a Taiwanese individual and his/ her related parties directly or indirectly holding 50% or more of the shares or capital of a foreign company in a low-tax jurisdiction, or having control over such a foreign company, the said foreign company is a CFC. CFC’s earnings shall be included in the basic income of Taiwanese individual shareholders whether the earnings are distributed to such shareholders or not.

Taxation of Stock Options

Stock options of Taiwan companies

For employee stock options issued by Taiwan companies, the spread (i.e. the fair market value of the stock on the exercise date over the exercise price) of the options is categorized as "other income" of an employee. This income should be reported in the employee's individual income tax return in the year of exercise.

According to Article 19-1 of the Statute for Industrial Innovation, where a company employee exercises employee stock options and acquires such shares, the employee may opt to defer the assessment of the income tax payable up to an annual total of NT$5 million worth of the acquired shares as calculated at the market price prevailing in the year of share acquisition or the year of share disposal until the year of transfer after the year he/she acquires the shares. Such employee who holds the shares and stays employed at the company for two years or more from the date he/she receives the shares may opt to include the entire transfer price or the aforementioned market price, whichever is lower, in their income for the year of transfer and declare their income tax.

Stock options of foreign companies

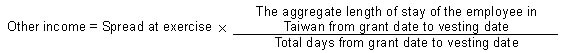

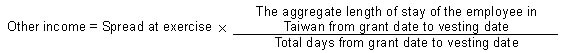

For employee stock options issued by foreign companies to its expatriates providing services in Taiwan or to employees in the subsidiary, branch or representative office of the foreign companies, the spread (i.e. the fair market value of the stock on the exercise date over exercise price) of the foreign stock is categorized as "other income" of an employee and the taxable income should be calculated according to the following formula:

If an employee does not render services in Taiwan from the grant date to the vesting date, there is no Taiwan-source income accordingly.

Income Tax on House and Land Transactions

The tax system of income tax on the consolidated income from house and land transactions was first introduced on January 1, 2016 and amended in 2021. Taking effect from July 1, 2021, the latest regulations of the amendment are briefly introduced as follows:

Tax Scope

Income derived from transactions of the following:

- House or land acquired on or after January 1, 2016.

- The right to use a house by creation of superficies acquired on or after January 1, 2016.

- Presale house with its building location acquired on or after January 1, 2016.

- The shares or capital, where more than half of the total number of shares or the total amount of capital of an enterprise within or outside the R.O.C. are/is directly or indirectly held by an individual, and at least 50% of the value of such shares or capital are constituted by house and land within the territory of the R.O.C.; however, such shall not apply if the shares are stocks in listed, OTC-listed, or emerging stock companies.

Tax Base and Declaration

Tax Base = the Revenue from the Transaction of House and Land-Costs-Expenses-the Total Increment Amounts of Land Value

An Individual shall fill out and file to the tax collection authority-in-charge the tax return within 30 days from the day as set forth below, attached with a photocopy of the contract and other relevant documents:

- The day following the day on which the ownership transfer registration of house or land is completed.

- The day following the transaction day of the right to use a house by creation of superficies.

- The day following the transaction day of presale house with its building location.

- The day following the transaction day of shares or capital that shall be regarded as the transactions of house and land.

Tax Rates

Residents

- Held no more than 2 years: 45%;

- Held more than 2 years, but no more than 5 years: 35%;

- Held more than 5 years, but no more than 10 years: 20%;

- Held more than 10 years: 15%;

- House and land that have been held for a period of no more than 5 years are transferred because of a job transfer, involuntary separation from employment, or any other involuntary cause announced by the Ministry of Finance: 20%;

- An individual who sells house and land where the house is built in partnership with a business entity, and the share of land associated with the unit has been held for a period of no more than 5 years: 20%;

- The portion of taxable income amount on self-use residence exceeds NT$ 4 million: 10%;

- House and the share of land associated with the house that are transferred for the first time after the completion of construction and have been held for a period of no more than 5 years, where the house and land are acquired through participation in urban renewal by providing land, legal buildings, other rights, or capital in accordance with the Urban Renewal Act or the participation in reconstruction in accordance with the Statute for Expediting Reconstruction of Urban Unsafe and Old Buildings: 20%.

Non-Residents

- Held no more than 2 years: 45%;

- Held more than 2 years: 35%;

The Tax Preferences

Self-use Residence

- The individual, his (her) spouse or their minor children have lived in, maintained their household registration at the self-use house, and have owned the house for 6 consecutive years, and the house and land have never been used for lease, business operation, or professional practice in the last 6 years before its sale.

- Tax exemption on taxable income under NT$ 4 million.

- No more than one self-use residence exemption may be claimed by members of a household in six years.

Self-use Residence Repurchase

A taxpayer, who sells self-use house and land and repurchases another self-use one within 2 years, can apply for a refund proportional to the repurchase price over the sales price times the tax amount as calculated under Article 14-5 of the Income Tax Act. However, if the taxpayer changes the usage or transfers a self-use house or a piece of land within 5 years after claiming the above tax preference, the deducted/refunded tax amounts should be returned.

Complementary Measures

- The tax revenues will be distributed to the expenditures on housing policy and long-term social care services.

- The regulations related to real-estate in the Specifically Selected Goods and Services Tax Act have been suspended since January 1, 2016.