Page 113 - 泰國

P. 113

租稅及金融制度

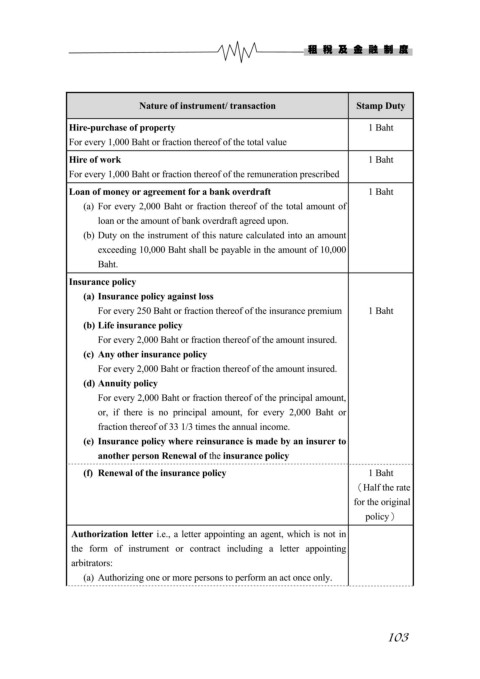

Nature of instrument/ transaction Stamp Duty

Hire-purchase of property 1 Baht

For every 1,000 Baht or fraction thereof of the total value

Hire of work 1 Baht

For every 1,000 Baht or fraction thereof of the remuneration prescribed

Loan of money or agreement for a bank overdraft 1 Baht

(a) For every 2,000 Baht or fraction thereof of the total amount of

loan or the amount of bank overdraft agreed upon.

(b) Duty on the instrument of this nature calculated into an amount

exceeding 10,000 Baht shall be payable in the amount of 10,000

Baht.

Insurance policy

(a) Insurance policy against loss

For every 250 Baht or fraction thereof of the insurance premium 1 Baht

(b) Life insurance policy

For every 2,000 Baht or fraction thereof of the amount insured.

(c) Any other insurance policy

For every 2,000 Baht or fraction thereof of the amount insured.

(d) Annuity policy

For every 2,000 Baht or fraction thereof of the principal amount,

or, if there is no principal amount, for every 2,000 Baht or

fraction thereof of 33 1/3 times the annual income.

(e) Insurance policy where reinsurance is made by an insurer to

another person Renewal of the insurance policy

(f) Renewal of the insurance policy 1 Baht

(Half the rate

for the original

policy)

Authorization letter i.e., a letter appointing an agent, which is not in

the form of instrument or contract including a letter appointing

arbitrators:

(a) Authorizing one or more persons to perform an act once only.

103