Page 111 - 泰國

P. 111

租稅及金融制度

第伍章 租稅及金融制度

一、租稅

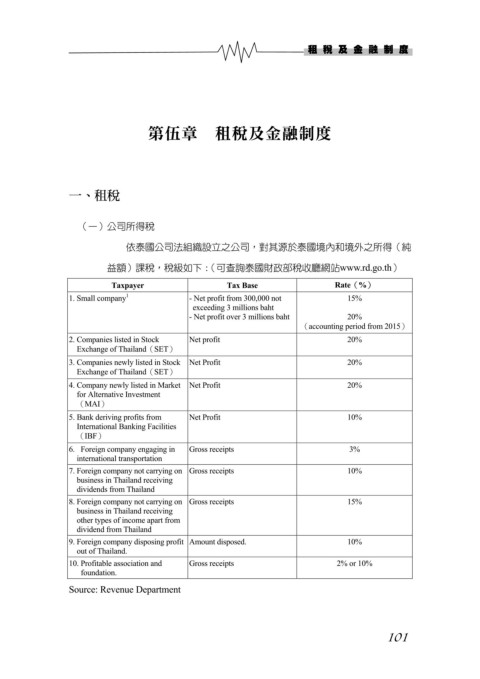

(一)公司所得稅

依泰國公司法組織設立之公司,對其源於泰國境內和境外之所得(純

益額)課稅,稅級如下:(可查詢泰國財政部稅收廳網站www.rd.go.th)

Taxpayer Tax Base Rate(%)

1

1. Small company - Net profit from 300,000 not 15%

exceeding 3 millions baht

- Net profit over 3 millions baht 20%

(accounting period from 2015)

2. Companies listed in Stock Net profit 20%

Exchange of Thailand(SET)

3. Companies newly listed in Stock Net Profit 20%

Exchange of Thailand(SET)

4. Company newly listed in Market Net Profit 20%

for Alternative Investment

(MAI)

5. Bank deriving profits from Net Profit 10%

International Banking Facilities

(IBF)

6. Foreign company engaging in Gross receipts 3%

international transportation

7. Foreign company not carrying on Gross receipts 10%

business in Thailand receiving

dividends from Thailand

8. Foreign company not carrying on Gross receipts 15%

business in Thailand receiving

other types of income apart from

dividend from Thailand

9. Foreign company disposing profit Amount disposed. 10%

out of Thailand.

10. Profitable association and Gross receipts 2% or 10%

foundation.

Source: Revenue Department

101