Page 116 - 泰國

P. 116

泰國投資環境簡介

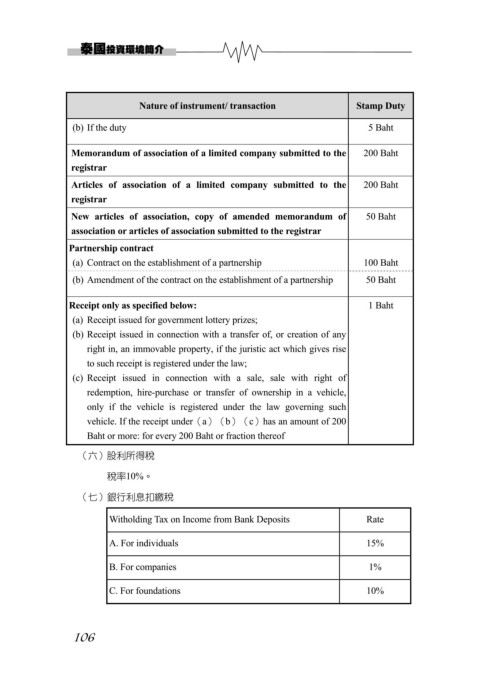

Nature of instrument/ transaction Stamp Duty

(b) If the duty 5 Baht

Memorandum of association of a limited company submitted to the 200 Baht

registrar

Articles of association of a limited company submitted to the 200 Baht

registrar

New articles of association, copy of amended memorandum of 50 Baht

association or articles of association submitted to the registrar

Partnership contract

(a) Contract on the establishment of a partnership 100 Baht

(b) Amendment of the contract on the establishment of a partnership 50 Baht

Receipt only as specified below: 1 Baht

(a) Receipt issued for government lottery prizes;

(b) Receipt issued in connection with a transfer of, or creation of any

right in, an immovable property, if the juristic act which gives rise

to such receipt is registered under the law;

(c) Receipt issued in connection with a sale, sale with right of

redemption, hire-purchase or transfer of ownership in a vehicle,

only if the vehicle is registered under the law governing such

vehicle. If the receipt under(a)(b)(c)has an amount of 200

Baht or more: for every 200 Baht or fraction thereof

(六)股利所得稅

稅率10%。

(七)銀行利息扣繳稅

Witholding Tax on Income from Bank Deposits Rate

A. For individuals 15%

B. For companies 1%

C. For foundations 10%

106