Page 115 - 泰國

P. 115

租稅及金融制度

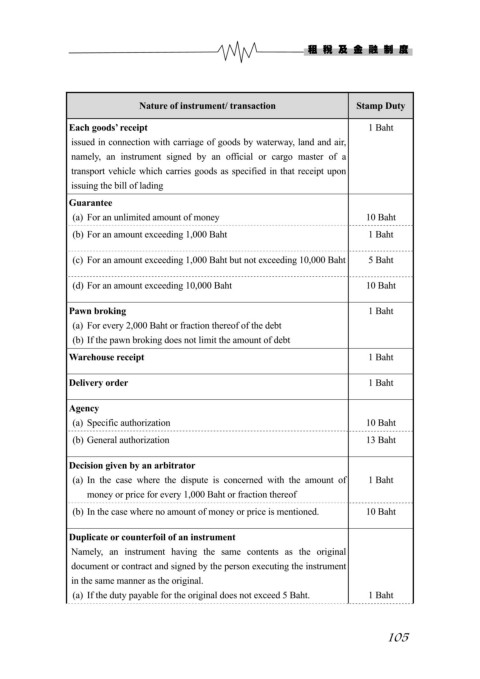

Nature of instrument/ transaction Stamp Duty

Each goods’ receipt 1 Baht

issued in connection with carriage of goods by waterway, land and air,

namely, an instrument signed by an official or cargo master of a

transport vehicle which carries goods as specified in that receipt upon

issuing the bill of lading

Guarantee

(a) For an unlimited amount of money 10 Baht

(b) For an amount exceeding 1,000 Baht 1 Baht

(c) For an amount exceeding 1,000 Baht but not exceeding 10,000 Baht 5 Baht

(d) For an amount exceeding 10,000 Baht 10 Baht

Pawn broking 1 Baht

(a) For every 2,000 Baht or fraction thereof of the debt

(b) If the pawn broking does not limit the amount of debt

Warehouse receipt 1 Baht

Delivery order 1 Baht

Agency

(a) Specific authorization 10 Baht

(b) General authorization 13 Baht

Decision given by an arbitrator

(a) In the case where the dispute is concerned with the amount of 1 Baht

money or price for every 1,000 Baht or fraction thereof

(b) In the case where no amount of money or price is mentioned. 10 Baht

Duplicate or counterfoil of an instrument

Namely, an instrument having the same contents as the original

document or contract and signed by the person executing the instrument

in the same manner as the original.

(a) If the duty payable for the original does not exceed 5 Baht. 1 Baht

105